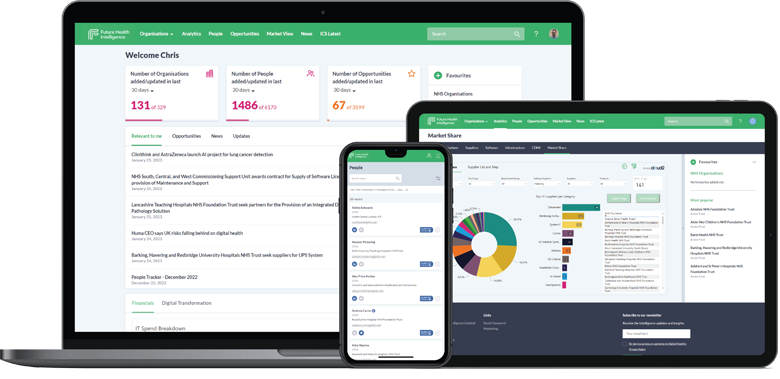

Win More NHS Contracts. Build Your Pipeline Faster.

Access comprehensive NHS IT market intelligence across all NHS trusts and ICBs, 9,000+ verified decision-maker contacts, real-time contract expiry dates, and competitive intelligence-all in one platform.

Navigate the £4bn UK health IT sector with confidence.

Market Analysis and Insight

Stop Wasting Time on Manual Research

Cut prospect research from days to minutes. Future Health Intelligence delivers census-level data on the £4 billion UK NHS IT market, helping you identify opportunities, reach decision-makers, and close deals faster.

What You Get:

- Make data-driven decisions with market share analysis and competitor tracking across all NHS trusts

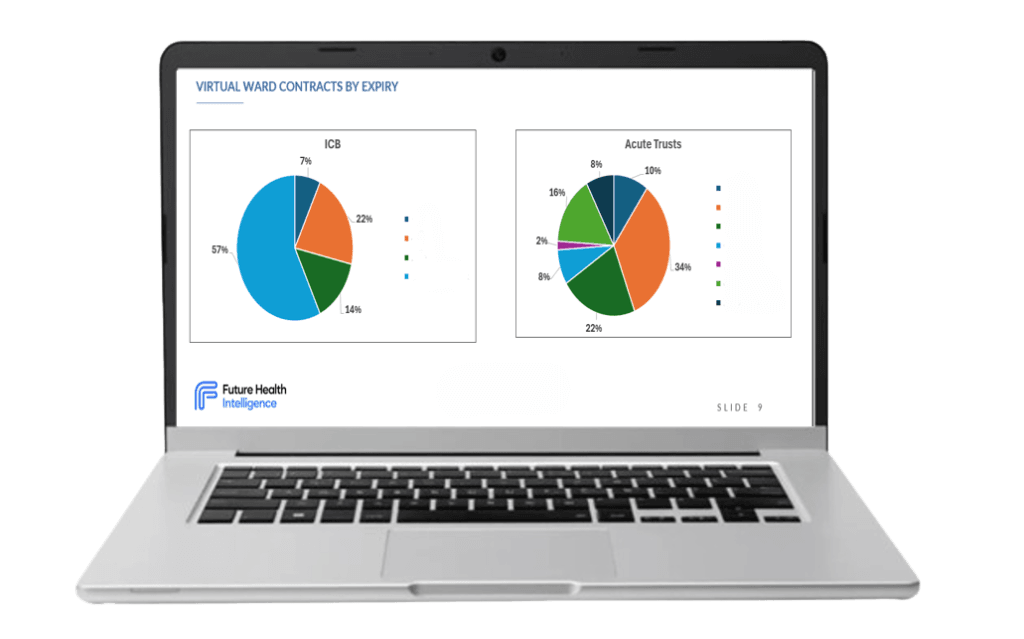

- Identify high-value opportunities with contract expiry alerts

- Monitor tenders in real-time with consolidated NHS IT frameworks and procurement opportunities, prior information notices, and contract awards

- Connect with the right people through our constantly verified database of 9,000+ NHS IT professionals and digital leaders

Intelligence That Drives Revenue

Source data directly from NHS organizations—not aggregators or outdated directories.

Our clients reduce prospect research time by up to 80%, turning scattered public information into actionable intelligence. Data is continuously updated and validated, ensuring you’re working with current information when targeting prospects.

Identify demand for your solution and qualify the NHS trusts based on purchase intent with census-level insight on organisational digital maturity, spending and contract ends dates.

Stay informed with the latest NHS IT framework, tender and procurement opportunities, all in one place.

Pinpoint and reach the right digital leaders and professionals through our comprehensive verified NHS IT database of 8,000+ contacts.

The definitive NHS IT database

We are a trusted authority on digital health – and the only provider of up-to-date granular information gathered at source.

Save time and budget with access to thousands of data points aggregated in one place.

Software Intelligence

Target the NHS software market with precision.

Track EPR rollouts, digital transformation initiatives, and software contract renewals across all 215 NHS trusts and 42 ICSs, NHS organisations across Wales, Northern Ireland and Scotland. And newly added private hospitals. Access detailed profiles on digital installed base, future planned investments, and purchasing authority to prioritise your highest-value prospects.

Infrastructure Intelligence

Capitalise on NHS infrastructure upgrades and modernisation.

Monitor cloud migrations, hardware refreshes, network improvements, and WiFi deployments with contract visibility including contract value where available. Identify opportunities in key digital infrastructure projects with key player information and contract end dates at your fingertips.

Complete UK Health Coverage Select Color

Organisations covered:

- NHS acute trusts

- Integrated care systems and Integrated Care Boards (ICS/ICB)

- NHS community services

- NHS mental health trusts

- NHS Ambulance trusts

- Government agencies (including NHS England)

- Scotland, Wales, Northern Ireland

One platform for multiple teams

Leadership & Strategy Teams

Complete market segmentation by product, supplier, and trust type

Competitive landscape analysis and market share visibility

Strategic insights to inform product development and key account planning

Track digital transformation initiatives across all NHS organizations

Sales Teams

Build your NHS IT pipeline in hours, not weeks

Prioritize prospects by contract end date, digital maturity, and budget authority

Access detailed NHS trust profiles before your first call

Find verified contact details for decision-makers - no more time-consuming searches

Target accounts with proven purchase intent

Marketing Teams

Segment audiences by digital maturity, spending, and technology adoption

Monitor competitor activity and market positioning

Build targeted campaigns with verified NHS IT decision-maker

Inform messaging and positioning with real market data

Identify high-value customer segments for focused outreach

Bid Teams

Track frameworks, tenders, prior information notices, and contract awards as published

Search, filter, and save opportunities that match your capabilities

Access organizational insights that strengthen your proposals

Reduce bid research time

Improve win rates with comprehensive trust intelligence

Bespoke Research

Custom Market Intelligence for Strategic Decisions

Get answers to your specific market questions. Our Bespoke Research service delivers tailored analysis and insights to support critical business decisions—from market entry to competitive positioning.

Built on the UK’s most comprehensive NHS and private hospital IT market data, combined with Bevan.ai’s analytical capabilities, we provide the strategic intelligence you need to move confidently.

Three Core Research Packages

Market Entry Analysis

- Market sizing and opportunity assessment

- Detailed competitor landscape analysis

- Routes to market evaluation and partner identification

- Procurement activity tracking and forecasting

Competitor Intelligence

- Strengths and weaknesses assessment across target segments

- Market share analysis and trends

- Contract award patterns and win/loss analysis

- Competitive positioning and differentiation opportunities

Market Segment Analysis

- Supplier landscape and market dynamics

- Procurement trends and contract award activity

- Early procurement signals by NHS trust

- Technology adoption patterns and future opportunities

Expert-Led Research

Led by Tola Sargeant,

Jon Hoeksma

Flexible Access

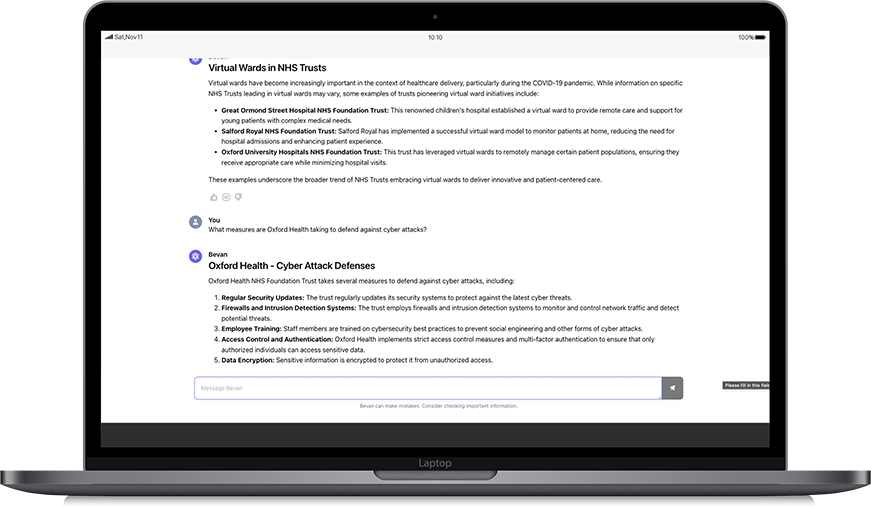

Introducing

AI-Powered NHS Strategy Analysis

Analyze 5,000+ NHS board papers instantly. Bevan.ai is the only LLM AI model trained specifically to provide insight and analysis on NHS use of digital and data.

Ask questions in plain English and extract strategic insights in seconds-not hours of manual reading:

- Understand current and planned digital initiatives across all English NHS trusts

- 100% coverage of 215 NHS trusts and 42 ICSs

- Query NHS strategies, digital roadmaps, and technology priorities

- Trained and validated by FHI team

Click to watch a short how-to video

Latest resources

“[Intelligence provides] an in-depth understanding of individual NHS organisations’ current and future digital requirements.”

Subscribed to by major NHS clinical system and infrastructure suppliers

Stay Ahead of the Market

Sign up for the Intelligence Newsletter to receive the latest NHS IT market insights, trends, and opportunities directly to your inbox.